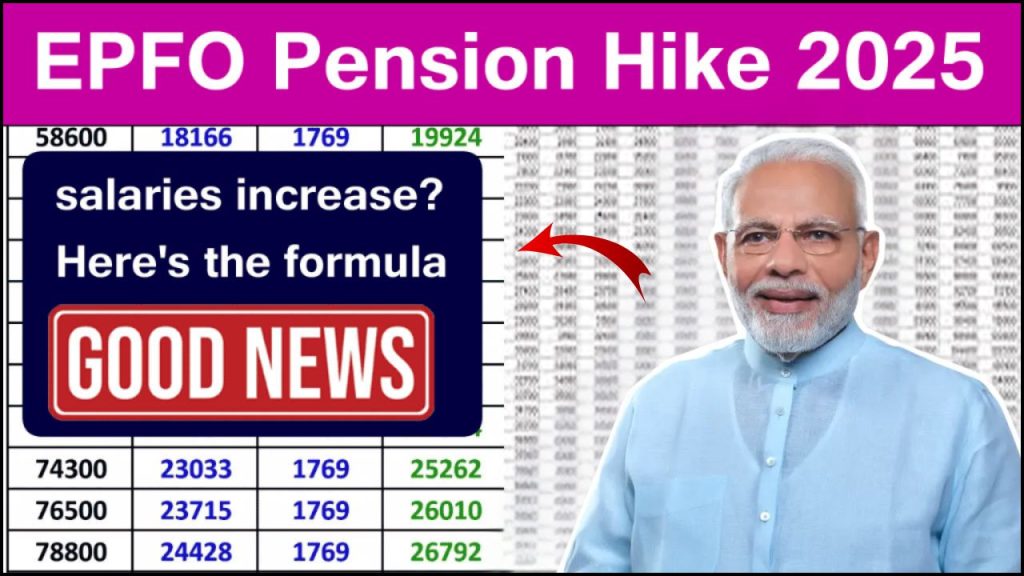

In a landmark decision, the Employees’ Provident Fund Organization (EPFO) has approved a major increase in the minimum monthly pension under the Employees’ Pension Scheme (EPS). Starting in 2025, pensioners will receive a revised minimum pension of ₹7,000 per month, a significant rise from the previous ₹1,000. Alongside this hike, the EPFO has also announced the introduction of Dearness Allowance (DA) for pensioners, addressing the long-standing demand for inflation-adjusted benefits. These sweeping changes are set to positively impact over six million pensioners across India, especially those from low-income backgrounds who depend heavily on their pension for daily sustenance.

Let’s take a closer look at the details, significance, and expected implications of this progressive step by the EPFO.

Highlights of the 2025 EPFO Pension Revision

The EPFO Pension Hike 2025 includes two major enhancements aimed at strengthening the financial position of retired employees:

1. Minimum Monthly Pension Increased to ₹7,000:

After years of stagnation, the baseline pension has now been substantially increased. The previous ₹1,000 minimum pension amount remained unchanged for several years and was insufficient to support pensioners amid rising inflation. This sevenfold hike is a much-needed correction and will bring financial relief to many elderly citizens.

2. Dearness Allowance (DA) Introduced for EPF Pensioners:

For the first time, DA will be extended to pensioners under the EPS. This move ensures that their pension keeps pace with inflation, safeguarding their purchasing power. The DA will be linked to the official inflation index and revised periodically to reflect market conditions. This aligns the EPFO pension scheme with other government-backed pension programs that already provide DA.

Together, these reforms signify a vital shift towards comprehensive and equitable social security for India’s retired population.

Why Was the Hike Necessary?

The decision to enhance the pension scheme stems from multiple socio-economic concerns:

- Stagnant Pension Amounts: The minimum pension of ₹1,000 has not seen any revisions in many years, rendering it insufficient in today’s cost-of-living scenario.

- Rising Cost of Living: With inflation impacting essential commodities, healthcare, and housing, pensioners found it difficult to manage basic needs on the existing pension.

- Disparity Among Pension Schemes: EPFO pensioners received considerably less compared to those in other government or private pension schemes. The gap had long been a matter of concern, prompting demands for parity.

- Support for Vulnerable Groups: A large portion of the 6 million beneficiaries are from economically weaker sections. For many, the pension is their only source of income post-retirement.

By addressing these issues, the EPFO has taken a major step toward improving the socio-economic well-being of India’s retired workforce.

How the Introduction of DA Will Help Pensioners?

Adding DA to the EPF pension scheme is a transformative measure, promising greater economic stability for pensioners:

- Protection Against Inflation: DA will act as a buffer, adjusting pensions to rising prices and thus preserving the pensioner’s ability to afford basic essentials.

- Regular Adjustments: The DA will be revised periodically, most likely in line with government inflation indexes, ensuring that the pension remains relevant to real-world market conditions.

- Enhanced Livelihood: The inclusion of DA means that retirees can now better afford quality healthcare, balanced nutrition, and other essentials, improving their overall standard of living.

This provision also brings the EPFO pension scheme more in line with the pension benefits enjoyed by retired government employees, closing the gap in financial security between different categories of pensioners.

What does this mean for Pensioners?

The revised pension policy is expected to yield far-reaching benefits:

- Financial Security: With a higher monthly payout and inflation-linked increments, retirees, particularly from the lower-income strata, will experience increased financial stability.

- Better Living Standards: Pensioners will have better access to medicines, medical treatments, nutritious food, and safer living arrangements, contributing to improved health and mental well-being.

- Reduced Dependency: A more substantial pension means fewer retirees will need to rely on family support or fall into poverty, which in turn lessens the financial burden on younger generations.

Overall, this update reaffirms the government’s commitment to uplifting the lives of India’s retired working class.

Frequently Asked Questions (FAQs)

1. What is the new minimum pension under the EPF scheme in 2025?

The minimum pension has been increased from ₹1,000 to ₹7,000 per month.

2. Who is eligible to benefit from this pension hike?

Over six million EPF pensioners, especially those from economically disadvantaged backgrounds, will benefit from this increase.

3. What is Dearness Allowance (DA)?

DA is a cost-of-living adjustment allowance designed to offset the impact of inflation. It ensures that pensioners retain their purchasing power.

Final Words

The EPFO’s decision to raise the minimum pension and introduce DA marks a new chapter in India’s social security landscape. It reflects a growing awareness of the financial challenges faced by retirees and a genuine effort to address those challenges through meaningful reforms. For millions of pensioners, especially those with no other income source, this hike promises not just monetary support but also dignity and peace of mind in their retirement years.

As we move forward in 2025, the EPFO Pension Hike is set to become a milestone in the journey toward inclusive and sustainable retirement solutions in India.